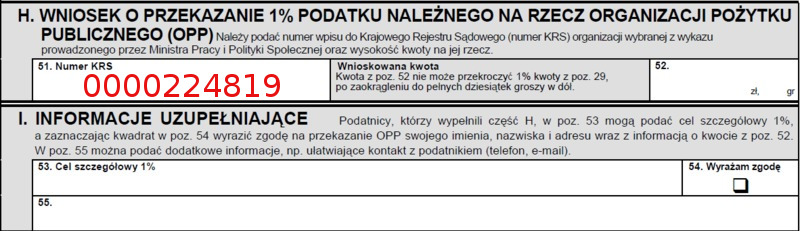

KRS 0000224819

The word “refugee” ignites a lot of emotions. Due to the dramatic occurrences in Syria and on the Mediterranean Sea in 2015, refugees had become a topic in European politics. But only the migration crisis on the polish-belarussian border in 2021 has put them in the centre of the public debate in Poland. Border zone residents, organisations and regular citizens got involved in helping. Us too. Our volunteers worked in Usnarz Górny in August, then helped in the woods and in hospitals.

Our involvement, even though paid off with physical and mental exhaustion, was obvious for us. We’ve worked with refugees since 2005. For nearly 10 years we’ve run a day room and integrational programme for children and women, victims of wars and abuse, in a refugee centre in Targówek. During these years we helped hundreds of people. Currently we’re supporting educational and integrational hardships of refugee families living in Podkowa Leśna-Dębak and Linin, and those who live on their own in Warsaw and the suburbs.

This was a hard time again…

Crises affect the weakest the most. 2020 was a huge challenge for everybody, but especially for refugees. Several dozen of “our” families faced the pandemic in the conditions of a collective quarantine. A lot of their past traumas floated to the surface again.

The year of 2021 was a continuation of challenges with education. A lack of a quiet working space in multiple-person rooms, a shortage of computers and IT exclusion of most of the mothers threatened to deepen children’s issues with studying and socialisation. Our educators were the only bridge between them and the school.

In spring we had to deal with the sudden closing of a centre for foreigners in Targówek. A private company had bought out the site and all families had to find new accommodation in just multiple months. This was a huge logistic obstacle for “our” families, which brought a lot of stress. For us, it meant moving our work to a different place, which is still very hard to reach. We had to reorganise, the costs also grew significantly. At the same time a group of several dozen Afghans reached our centre in Podkowa Leśna-Dębak. Integration of the new-comers with the Chechen community, adaptation of children to completely new conditions and a schooling system, coordination of bottom-up operations are only a part of the challenges we dealt with during autumn of 2021.

2022 was influenced heavily by the war in Ukraine. Apart from the effort put into the help for new refugees (read more about it here), we continued working in Podkowa Leśna-Dębak and opened a new recreation room (Przystanek “Świetlica”) in the centre in Linin.

“Przystanek” in 2022:

598 hours of educational classes for 80 children

150 days of an open recreation room

226 hours of individual work with families

60 families covered by our aid, which also consisted of 6 workshops

13 trips and integrational events, including sport and educational ones

192 hours of cultural assistants’ work

opening of a recreation room in Linin

renovation of the recreation room in Podkowa Leśna-Dębak

How do we spend the 1.5%?

The monthly cost of our programme is around 15 thousand zloty. Above all it consists of many hours of qualified personnel’s work, who teaches and plays with children, organises recreation room’s work, goes on trips with the families, diagnoses newcomers, translates documents and conversations and covers dozens of day-to-day individual cases with doctors, schools or lawyers.

Our costs are also the salary of a coordinator and psychologist, who takes care of the well-being of around 10 workers, pricey and long journeys to reach the centre, books, games, educational materials and transport or tickets we need on trips, finally administrative costs – rent, electricity, telecommunication and accountancy. You can find detailed reports here (in polish).

Pass on 1.5% to an organisation with experience in educational and integrational work for refugees.

Pass the 1.5%

Passing on 1.5% of the tax is very easy and doesn’t require any payments or waiting for a payback from the tax office. It’s made online, no cash involved. You just have to write-in our KRS number in your tax declaration.

PITax

Free tax report in an electronic form (e-PIT) with all reliefs. Use free support from tax specialists. You can print out the report or send it online.

PITax is a professional programme for declaring your PIT tax. You can account and send all kinds of PIT to the Tax Office. You can deduct all reliefs, including child relief, internet relief, rehabilitation relief. Free of charge and restrictions.

Twój e-PIT (Your e-PIT)

Use the governmental tax portal https://www.podatki.gov.pl/pit/twoj-e-pit/ to calculate and declare your tax.

If you already passed your 1.5% (earlier 1%) for Foundation for Freedom all you have to do is check if the right KRS 0000224819 number is showing and accept the declaration. If you’re passing it for the first time, write in our KRS number or click “change organisation”/”zmień organizację”.

Tax Office – on paper

In the tax declaration write in our KRS number (51.) and the calculated 1.5% of your income tax (52.).

Below the section with the space for KRS number you can write in the exact information and cause. Exact cause could be one of our programmes, for example Przystanek “Świetlica”. Position 54 is the agreement for us to process your information, like your name and address as well as the amount of the contribution. Position 55 is you prefered way of contact – like your phone number or e-mail. REMEMBER! This section is not necessary and even if you don’t fill it, we will recieve the contribution.

Who can pass the 1.5%?

Flat rate workers – PIT 28, entrepreneurs – PIT 36, linear-company owners – PIT 36L, workers – PIT 37, stock players – PIT 38, people who sold their estate – PIT 39.

Thank you!